Almanacs “The Almanac - Jan. 4 - Post Chronicle” plus 4 more |

- The Almanac - Jan. 4 - Post Chronicle

- January effect may set markets' tone for New Year - Associated Press

- January effect may set tone for market - Texarkana Gazette

- Dawn of a New Economic Year: January Indicators - Seekingalpha.com

- Stock market faces ’10 test - Norristown Times Herald

| The Almanac - Jan. 4 - Post Chronicle Posted: 04 Jan 2010 04:54 AM PST Today is Monday, Jan. 4, the fourth day of 2010, with 361 to follow. The moon is waning. The morning stars are Venus and Mars. The evening stars are Mercury, Saturn, Jupiter, Uranus and Neptune. Those born on this date were under the sign of Capricorn. They include folklore and fairy tale collector Jacob Grimm in 1785; teacher of the blind Louis Braille in 1809; shorthand writing system inventor Isaac Pitman in 1813; Charles Stratton, the midget known as Gen. Tom Thumb, a famous entertainer and protege of showman P.T. Barnum, in 1838; U.S. Sen. Everett Dirksen, R-Ill., in 1896; Pro Football Hall of Fame coach and player Don Shula in 1930 (age 80); former heavyweight boxing champion Floyd Patterson in 1935; actress Dyan Cannon in 1937 (age 73); author Maureen Reagan in 1941; American historian and writer Doris Kearns Goodwin, in 1943 (age 67); R.E.M. lead singer Michael Stipe in 1960 (age 50); and actors Dave Foley in 1963 (age 47) and Julia Ormond in 1965 (age 45). On this date in history: In 1885, Dr. William Grant of Davenport, Iowa, performed the first successful appendectomy. In 1893, U.S. President Benjamin Harrison granted amnesty to all people who had abstained from practicing polygamy since Nov. 1, 1890. It was part of a deal for Utah to achieve statehood. In 1896, Utah admitted to the United States as the 45th state. In 1935, Bob Hope made his network radio debut in the cast of "The Intimate Revue." In 1936, Billboard magazine published the first pop music chart. In 1951, Chinese and North Korean forces captured the South Korean capital of Seoul. In 1954, a struggling young musician who worked in a machine shop paid $4 to record two songs for his mother. His name: Elvis Presley. In 1965, U.S. President Lyndon Johnson proclaims the "Great Society" policy during a State of the Union address to Congress. In 1974, U.S. President Richard Nixon refused to release any more of the 500 documents subpoenaed by the U.S. Senate Watergate Committee. In 1975, Elizabeth Ann Seton is canonized as the first Roman Catholic saint born in America. In 1985, Israel confirmed that 10,000 Ethiopian Jews had been flown to Israel. Ethiopia termed the operation "a gross interference" in its affairs. In 1987, Spanish guitar great Andres Segovia arrived in the United States for his final American tour. He died four months later in Madrid at the age of 94. In 1993, 25 people, including 18 Americans, were killed when their tour bus traveling on a rain-slick highway near Cancun, Mexico, crashed into a utility pole and burned. In 1994, Mexican government troops were sent into the southeastern state of Chiapas to quell a rebellion by the Zapatista National Liberation Army. In 1995, the 104th U.S. Congress convened with Republicans in control in both houses for the first time since 1953. In 2000, U.S. President Bill Clinton nominated Alan Greenspan to a fourth four-year term as chairman of the Federal Reserve. In 2004, the unmanned Mars spacecraft began relaying pictures of a rock-strewn plain to Earth as scientists looked for signs the planet once had water and perhaps life. In 2005, gunmen assassinated the governor of Baghdad, Ali al-Haidri. In 2006, Israeli Prime Minister Ariel Sharon suffered a major stroke and underwent emergency surgery to stop bleeding on the brain. Sharon, 77, had a mild stroke about two weeks earlier. Deputy Prime Minister Ehud Olmert assumed his duties. In 2007, the 110th U.S. Congress met for the first time with Democrats holding control of both House of Representatives and Senate. Rep. Nancy Pelosi, D-Calif., became the first woman elected speaker of the House. In 2008, the U.S. Labor Department said the American unemployment figure was 5 percent in December. In 2009, U.S. President-elect Barack Obama and congressional Democrats considered $300 billion in individual and business tax cuts. Cuts would be intended in part to encourage businesses to hire workers and reduce taxes on middle-class taxpayers. A thought for the day: it was Frederick Douglass who wrote, "Without a struggle, there can be no progress." (c) UPI Five Filters featured article: Chilcot Inquiry. Available tools: PDF Newspaper, Full Text RSS, Term Extraction. |

| January effect may set markets' tone for New Year - Associated Press Posted: 04 Jan 2010 04:39 AM PST CHARLOTTE, N.C. (AP) -- The stock market faces a big test as 2010 trading gets under way: whether its performance will be lifted by the phenomenon known as the January effect, or squelched by uncertainty about the economy. The January effect is the buying blip that often occurs with the start of a new tax year. Investors who sold stock before the end of the old year to claim a tax loss reinvest that money when trading begins again. Market historians and many investors are fascinated by the January effect because it often sets the tone for the rest of the year. In 2009, stocks were up at the start of January; although they were at 12-year lows two months later, they ended the year having had their best performance since 2003. "If the first five trading days of January are up, the end of January will usually be up and the correlated end of the year is usually up," says Ray Harrison, Principal of Harrison Financial Group in Citrus Heights, Calif. "I say, usually, but I believe we're headed that way." The economy, however, could trip up a January effect. The coming week brings some critical economic reports including the Labor Department's employment report for December. The government's news last month that employers cut just 11,000 jobs in November, far fewer than the market anticipated, has lifted expectations for the report due out Friday. Economists surveyed by Thomson Reuters are forecasting on average that 23,000 jobs were lost. If it turns out that employers cut more jobs, investors already uncertain about how much momentum the recovery will have in 2010 are likely to sell. But a surprisingly strong report could have an equally chilling effect on stocks. The concern in the market is that a healthier economy will lead the Federal Reserve to pull back its stimulus measures, and investors aren't sure of the economy's ability to flourish on its own. The January effect could also be threatened by fourth-quarter earnings. Investors have already been pricing in strong earnings reports, especially since the results are being compared against companies' terrible results from the final three months of 2008. But if the reports aren't strong enough, if companies are still showing weak revenue growth or if their outlooks for the future fall short of expectations, January could be a troubling month in the market. "Earnings are critical. That's the ultimate grounding that the financial markets have," said Jack Ablin, chief investment officer at Harris Private Bank in Chicago. "If something is off, the market may have a small pullback." Still, if the January effect holds, there will be plenty of gains to be had, especially if small cap stocks, as expected, outperform big and midcap stocks. Typically, mutual fund managers and other institutional investors, who sell off the shares of riskier small companies to make their end-of-year balance sheets look better, then buy them back early in the new year. "It's competitive among money market managers," Harrison said. "They want to outpace their peers, and they will invest early and more in the market." Since 1950, there have been only five times when the January effect turned out to be a poor indicator of the rest of the year, according to the "Stock Trader's Almanac," a book that tracks market trends. For some, however, "January may be a letdown," Ablin said. He said it's difficult for investors to profit from the January effect because the market now expects it to happen and therefore prices it in before the end of the old year. Ken Grant, partner at Waterstone Private Wealth Management in Tulsa, Olka., says ultimately, the markets do not follow calendar or tax deadlines. "You can try, but all these economic cycles move at their own pace," he said. © 2010 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed. Learn more about our Privacy Policy. Five Filters featured article: Chilcot Inquiry. Available tools: PDF Newspaper, Full Text RSS, Term Extraction. |

| January effect may set tone for market - Texarkana Gazette Posted: 04 Jan 2010 05:44 AM PST [fivefilters.org: unable to retrieve full-text content] CHARLOTTE, N.C.—The stock market faces a big test as 2010 trading gets under way: whether its performance will be lifted by the phenomenon known as the January effect, or squelched by uncertainty about the economy. The January effect is the buying ... |

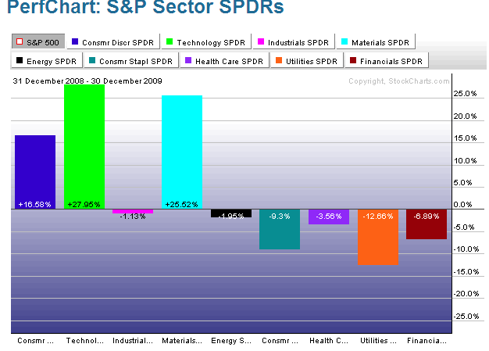

| Dawn of a New Economic Year: January Indicators - Seekingalpha.com Posted: 04 Jan 2010 04:54 AM PST As we stand at the beginning of a new year, let's take a moment for a last look back at 2009. For the year, the S&P 500 put in a dazzling performance in 2009, many sectors were even more impressive. The commodity sector led the way, along with the emerging world and Pacific Basin, and regarding major U.S. sectors, only consumer discretionary, technology and materials beat the S&P 500 in this strangest of all years as shown in the chart below: Chart courtesy of Stockcharts.com Even less encouraging is the fact that we're just finishing up the second worst decade on record for the Dow Jones Industrials, with the only worse decade occurring in the 1930s during the Great Depression. The S&P 500 is down some -24% over ten years. The NASDAQ is even worse, down nearly -50% while the Dow is down approximately -6%. The decade saw two bear markets with the "tech wreck" in 2000 and the "Great Recession" in 2008, and while recovery seems to be at hand, we hope, the S&P is still only half way back from its lows to its 2007 high in spite of this year's strong performance. A Look AheadLooking ahead is always an uncertain exercise, but best estimates are for 3% growth for 2010 with unemployment remaining high; in fact there are 2.3 million fewer jobs in America now than in 2000. Real estate appears to be stabilizing but experts say it could still fall further, particularly in California, Arizona and Florida as AltA loans reset and the commercial sector faces a wave of refinancing, causing foreclosures to remain high and continued downward pressure on prices. The Fed has to unwind its loose monetary policies at some point and interest rates appear to be on the rise in response to the unprecedented amount of government debt that needs to be refinanced. The big themes for 2010 will likely be: Three January trends to watch for that might predict how 2010 could go.

The First Five Days of January historically have been a reliable indicator of what the coming year will look like. If the market has been up after the first five days, the year produced gains more than 80% of the time.

Since 1950, January has accurately predicted the year's outcome with a more than 90% accuracy ratio. If the S&P is up for the full month of January, the rest of the year has been up, as well.

Since 1970, the top ten industries for January have beaten the S&P 500 more than 75% of the time. Why do these January predictors seem to work? The historical data presented in this article comes courtesy of "Stock Traders Almanac," and no one knows for sure why these patterns tend to repeat themselves, just like no one knows why there's usually a "Santa Rally" or why October tends to be the month for major stock market crashes. Maybe it's just human psychology at work or maybe it's because January is a busy time for new beginnings and new annual budgets and priorities for the country and individuals, as well. Or maybe, it's just chance, although there seems to be more than just "the law of averages" at work in these results. But like every indicator, they're not foolproof because January, 2009, was a down month but we all know now that 2009 was the strangest of all years with the S&P crashing into March and then climbing to finish with greater than 20% gains. The "First Five Days" indicator was accurate because the S&P climbed 0.38% the first week while "Hot Sectors Stay Hot" was mixed with copper and Brazil advancing for month and the year while other major sectors were down in January but up for the year. As investors, we're constantly looking for new ways to understand the market and its direction, and it would be nice to have the proverbial crystal ball. Unfortunately, none of us do and the best we can do is gauge probabilities of what might be to come. The View from 35,000 FeetThe news last week was mostly good with weekly jobless claims declining by 22,000 to reach the lowest level in 18 months and the Case/Shiller housing index, existing home sales, durable goods and consumer confidence all registering improvements over prior readings. Next week will bring us some important economic reports that will likely set the tone for January with news from the manufacturing sector, housing, and the monthly employment report on Friday. The Week Ahead

Monday: November Construction Spending, December Institute of Supply Management report Tuesday: November Factory Orders, November Pending Home Sales, December Auto Sales. Wednesday: December ADP Employment Report, December ISM Services Sector Thursday: Weekly Jobless Claims, Continuing Claims Friday: December Non Farm Payrolls, December Unemployment, November Wholesale Inventories, November Consumer Credit Sector Spotlight

Leaders: (USO) Oil, (EWT) Taiwan, (JJC) Copper Laggards: Mexico (EWW) Disclosure: No positions Five Filters featured article: Chilcot Inquiry. Available tools: PDF Newspaper, Full Text RSS, Term Extraction. |

| Stock market faces ’10 test - Norristown Times Herald Posted: 04 Jan 2010 06:05 AM PST CHARLOTTE, N.C. (AP) — The stock market faces a big test as 2010 trading gets under way: whether its performance will be lifted by the phenomenon known as the January effect, or squelched by uncertainty about the economy. Five Filters featured article: Chilcot Inquiry. Available tools: PDF Newspaper, Full Text RSS, Term Extraction. |

| You are subscribed to email updates from Almanacs - Bing News To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 comments:

Post a Comment