Almanacs “Natural Gas: America's Energy Salvation - Stockhouse” plus 4 more |

- Natural Gas: America's Energy Salvation - Stockhouse

- Pennsylvania man spends a year documenting folk art on barns - PennLive.com

- Are ETF Trendline Changes on the Way? - Seekingalpha.com

- Daily almanac - Columbus Dispatch

- On Native Ground - American Reporter

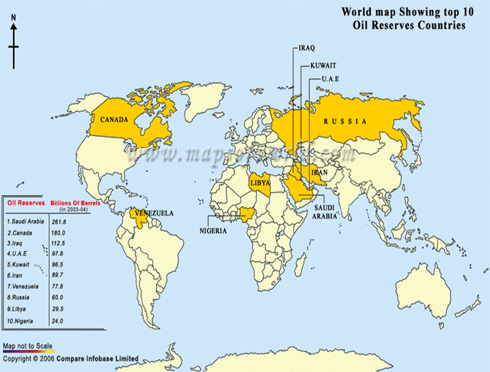

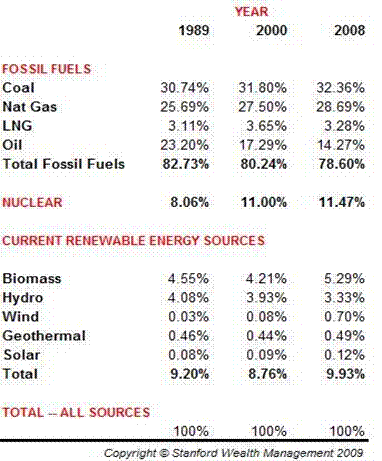

| Natural Gas: America's Energy Salvation - Stockhouse Posted: 01 Nov 2009 05:19 AM PST September 06, 2009| about: FCG / KOL / UNG / USO Natural gas will be America's energy salvation. If you thinksolar, biomass, wind, lithium ion-powered, ocean thermal, currents andtides, and even tried-and-true geothermal and hydroelectric willsomehow in the aggregate equal natural gas as a share of energyproduction, read here and here. It'stime we stopped hiding our heads in the sand about today's energyproblems while spending / wasting tens of billions of dollars ontaxpayer-funded grants, incentives and subsidies for tomorrow'ssolutions. We need – and have readily available – an American source ofrelatively clean energy today for today's needs, if only thepoliticians would stop spending on pork and get the hell out of the wayof private industry that is trying to provide this source:clean-burning natural gas. We pay much more for theelectricity to power and light our homes and offices, the coal, heatingoil or gas to heat our homes, and the gasoline to fill our automobiles,than we typically recognize. We pay once to the utilities orat the pump, and once more when our taxes are withheld from ourpaychecks. Big government pork for ethanol subsidies, solar subsidies,biomass subsidies, and every other kind ofcan't-stand-on-its-own-economics power are costing us, not just inmonetary terms but in time value – we are looking so far down the roadwe don't even see the 30-foot drop-off right in front of us. Think $4 agallon for gasoline is high? Add in the subsidies your tax dollars arediverted to for a $0 return and you're probably paying closer to $6 agallon. I say remove the subsidies, credits, and grants from allsources of energy. Big oil gets no special allowances for depletion.That's the industry you chose, bubbas. You knew it was a wasting assetwhen you decided to enter the business. Same for natural gas and coalcompanies. And the same for nuclear, wind, solar, biomass, et al. Cleanrenewable energy that is not a wasting asset remains the Holy Grail ofenergy production. If we shut off the spigot of vote-buying that comesfrom dispensing grants and subsidies, energy companies will still seekways to harness the power of the sun and the wind. As long as the sunstill shines, those who can turn this diffuse energy into aconcentrated form will make money. But I'm tired of effectively paying$6 a gallon for gasoline when alternatives exist that are beingignored. Why are they being ignored? Mostly, so some people can feelmorally superior while they freeze in the dark. Me. I'm not into moralsuperiority. I'd rather have a clean, well-lit place to work and livethan to feel smug about my energy "consciousness." I'd like tosee clean solar and wind as much as the next guy, but I won't wearrose-colored glasses. I can't ignore the fact that, after 30 years and$30 billion in subsidies, wind now meets 7/10 of 1% of US energy needs(about the same as when farmers used windmills 150 years ago) and solaris 12/100 of 1%. Let's round those up to 1%. There are 1,440 minutes ina day. Are you willing to have your lights, air conditioner, computer,stove and every other appliance and convenience on just 14.4 minutes aday? Welcome to Baghdad. Why Natural Gas Naturalgas is the second-most abundant fossil fuel in America. Coal is first.We are the Saudi Arabia of coal worldwide. China and India togetherdon't have as much coal as the US, which has 28% of the entire world'sreserves. But coal is dirty. Lots of for-profit firms are doingbreakneck research to clean it up, but it's – currently – dirty. Sois our choice dirty polluting coal or 14.4 minutes of power a day? Ofcourse not. There's imported oil. However, with the exception oftar-sands oil from Canada, when you add, to the $70 a barrel oil costswhen ready for export, the transportation costs, the cost of keepingthe Straits of Hormuz open, the costs of foreign wars to assure thecontinuing supply, the cost of the inevitable oil spills from time totime, and the foreign aid and sweetheart deals our nation makes to keeptyrants, misogynists, and perverts atop otherwise-shaky regimes, thetrue cost of oil is probably already $200-$300 a barrel (click to enlarge).

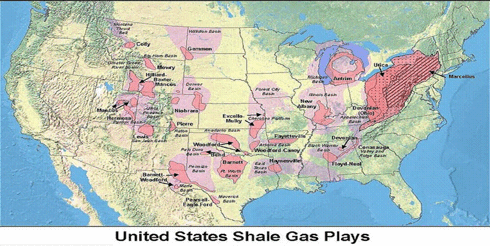

Journalists,however, are more enamored of something new! and different! andtherefore write reams on renewables and virtually nothing aboutsomething old and boring (but tried and true) like fossil fuels, soit's easy to believe renewables constitute a larger proportion thanthey really do. Note, for instance, in the previous chart, theless-than-amazing ascent of heavily-subsidized solar from 8/100 of 1%20 years ago to 12/100 of 1% today. That's not to denigrate solar or to"wish" that it couldn't have gone from 8/100 to 8% or 100%. But we mustdeal in facts if we are to ever wean ourselves from foreign oil andstop walking on eggshells around despots and ideological and religiousfanatics. HERE's "Why Natural Gas" 1.According to Oil & Gas Weekly and the Energy InformationAdministration we have upwards of 100 years of natural gas remaining inthe US at current rates of usage. 2. The estimate of provenreserves leapt *35%* in just the past year (creating downward pressureon prices in the short term.) No surprise to me. Every year of my 40years in this business, I've been hearing about peak oil in somevariation or another. "The world is running out of fossil fuels! We'reall going to freeze to death! We must subsidize unproven technologiesto save us from Armageddon!" What a bunch of hooey. Every yearsince the first Cassandra screamed this nonsense in my ear, we haveincreased our estimates of proven reserves. As technology allows us tofind and produce gas from previously unknown or inaccessible formation,we'll find even more. 3. Add Canada's natural gas to the mix,since Canada is our biggest trading partner and the US is their closest(thus cheapest-to-transport-to) customer, and they have an abundance ofnat-gas beyond the needs of their population. And since liquefyingnatural gas is expensive and potentially dangerous, it's best topipeline it from close-by fields rather than ship it liquefied acrossthe world's oceans. 4. If we use more U.S. natural gas, we cantell the likes of Saudi Arabia, Iran, Iraq, Russia, Nigeria andVenezuela "no thanks" to their bribery, corruption and fleecing. Take a look at the map below (click to enlarge). These are our now-known, proven shale gas reserves. Now note how close most are to population centers...

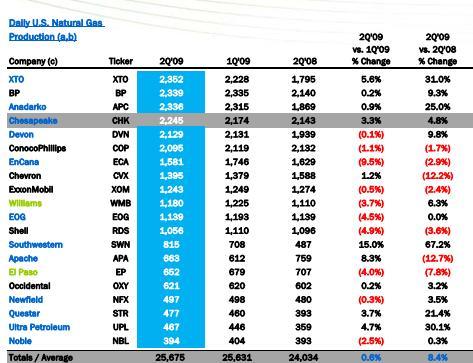

Inprevious articles, I began making the case for both nuclear and naturalgas. I still believe both offer remarkably good investmentopportunities in the months, years and decades ahead -- but I thinknatural gas will be the first to benefit. Why? 1. People arebeginning to realize, in spite of Al Gore's conflict-of-interesthawking of renewables he's invested in, that nat-gas is the cleanestburning fossil fuel, is available in quantity right here at home, andis used to heat our homes, cook our food, power the electricity thatturns on our lights and fuel the 7 million natural gas vehiclescurrently in use around the world. 2. The glut in supply ofnatural gas is both temporary and price-sensitive. The glut was createdby new production coming online from shale gas plays. But at today'sprices, those wells are being shuttered. What company could stay inbusiness if they were to sell gas at $2.56 per million BTUs (MMBtu)when it costs them $5.15 per MMBtu to get it out of the ground? 3.The natural gas glut is not only price-sensitive, it is seasonal, aswell. As the winter season cranks up over the coming months, utilitieswill need to produce more natural gas-generated heat. As the days growlonger, we'll turn our lights on earlier in the day and, if this yearis like every other, we'll settle in, turn up the electric blankets,play more electronic games, and cook more at home – primarilybenefiting nat-gas and coal as the two primary generators ofelectricity in this country. (With nuclear close behind, the three ofthem accounting for 90% of our electrical generating fuel sources. Addhydroelectric and that leaves just 4% generated by oil, biomass,vegetable oil, solar, wind, etc.) I believe natural gas is unlikely to remain depressed. Thisis a seasonal play that hasn't changed in 50 years, yet the mediaalways project declines or rises -- in any commodity, trend or stock --as if they were linear. The market, however, is cyclical, not linear... 4. The Farmers' Almanac is predicting a cold winter. The squirrels,chipmunks and birds in my large yard seem to agree. All are scurryingabout hiding food from each other earlier than I've ever seen. TheAlmanac predicts numbing cold from the Rocky Mountains to theAppalachians, with milder weather on the coasts. The National WeatherService is calling for a warmer-than-normal winter because of El Nino.In my experience, the animals get it right more often than the humans… 5. Natural gas-fired plants are currently operating at less than 50%capacity. If this administration and this country is really seriousabout cutting carbon emissions we will turn to natural gas now, notwhen two guys in their garage find the solar Holy Grail. Nextweek, I will write an article on the three E&P (exploration andproduction) firms I believe will benefit most from an increase inAmerica's reliance upon "home-grown," abundant, and cheap natural gas.I'll also review what I think are the smartest natural gas pipelinesfor both income and growth.

Ifyou can't wait until then, here's an ETF that I believe accuratelycovers the whole industry: the First Trust ISE-Revere Natural Gas IndexFund (FCG).I know and respect some of the principals at Revere ("Revere Data") andam quite familiar with their methodology and hierarchy that creates aproduct- and service-based classification system to map where and howcompanies interact and compete. FCG would be a good adjunct tothe pipelines mentioned above in that it selects companies on theexploration and production side of the business. It selects only thetop 30 stocks based upon an internal ranking system, then rebalances ona quarterly basis. Be aware that this methodology will add a level of"active" management versus the passive nature of many ETFs. That mightbe good, it might be bad, but I see FCG as a great way to give us broadexposure to the entire industry. Full Disclosure: We are long pilot positions in FCG. The Fine Print: AsRegistered Investment Advisors, we see it as our responsibility toadvise the following: We do not know your personal financial situation,so the information contained in this communiqué represents the opinionsof the staff of Stanford Wealth Management, and should not be construedas personalized investment advice. This content has passed through fivefilters.org. | |

| Pennsylvania man spends a year documenting folk art on barns - PennLive.com Posted: 01 Nov 2009 06:02 AM PST By The Associated PressNovember 01, 2009, 8:54AM View full sizePatrick Donmoyer, 23, stands at the door of a barn decorated with a Pennsylvania German star at the Pennsylvania German Cultural Heritage Center where he works at Kutztown University in Kutztown, Pa. View full sizePatrick Donmoyer, 23, stands at the door of a barn decorated with a Pennsylvania German star at the Pennsylvania German Cultural Heritage Center where he works at Kutztown University in Kutztown, Pa. KUTZTOWN, Pa. — Stars. Not hex signs, but stars. Patrick Donmoyer, 23, has spent more than a year documenting and photographing 400 examples of such celestial iconography, a form of folk art painted on Pennsylvania barns over the last three centuries. To Donmoyer, these stars matter as emblems of Pennsylvania German cultural identity. He is a true fan, albeit an academic one, who also believes that what these artistic creations are actually called matters for reasons of historical accuracy and meaning. Donmoyer is originally from Lebanon County. He lives about 10 miles northeast of Reading, near Fleetwood in Rockland Township, Berks County. He works at the nearby Pennsylvania German Cultural Heritage Center at Kutztown University. A 2009 graduate of Kutztown University, majoring in studio art and fine craft and minoring in Pennsylvania German studies, he has received a $5,000 research scholarship from the Peter Wentz Farmstead Society, based in Worcester, less than 20 miles northwest of Philadelphia. While his current focus is the Berks County area that surrounds Reading, he hopes to expand his study of barn stars into neighboring counties and publish a book. Standing on the academic shoulders of earlier Pennsylvania German scholars, Alfred Shoemaker and Don Yoder, in particular, Donmoyer credits them as figures who inspired him on a mission to catalog barn stars. "In Pennsylvania, we are experiencing enormous shifts in our local landscape, and many historical and culturally significant features are rapidly disappearing," Donmoyer said. "As our landscape shifts, so does our cultural heritage and beliefs. The most threatened aspects of the landscape are the historic farms because of development." Through his work, Donmoyer hopes to help preserve and share the artistic beauty of barn stars and educate others about a type of folk art that often has been clouded by controversy. "The problem is we don't have primary sources on the true meaning and content of these elaborate designs that were painted on barns," Donmoyer said, sitting outside at a picnic table and in front of the Sharidan family barn (circa 1855), boasting a stone foundation and timber-framed, red-painted walls adorned with stars. The barn is located near Kutztown University, in Maxatawny Township. Popularized as hex signs in the early 20th century, the barn stars were associated with the idea of protecting barns from witchcraft and became a commercial commodity in promoting the geographic area for tourists, according to Donmoyer. "Meanings were invented to attract customers, and this invented lore assigned a specific meaning to each design such as 'protection,' 'fertility,' 'love and romance' etc.," Donmoyer said. "This perception has tainted the genuine lore of the designs and their true implications." To counteract the invented history of the so-called hex signs, Pennsylvania German scholars promoted the idea that the folk art was done "just for nice" and served as purely decorative with no particular meaning, glossing over, in Donmoyer's view, the celestial and religious iconography on barn stars that would often date back to the late 18th century. "I attempt to answer the question of why an agricultural society, such as the Pennsylvania Germans, favored symbols and icons which feature celestial images such as suns, moons and stars that could also be embellished with flowers or crosses," Donmoyer said. For Donmoyer, the barn stars are actually an artistic reflection of early Pennsylvania German beliefs, a complex mixture of mystical Christianity accompanied by a practical folk-religious orientation that governed daily living. "The stars were seen as beacons of celestial order, which allow us an understanding of the passage of time and the progression of human activities which are governed by the stars," Donmoyer said. "It is well-documented that the Pennsylvania Germans orchestrated their planting, harvesting and tilling to the phase of the moon and the astrological signs. "Almanacs informed farmers which times were best for all manner of agricultural activities such as planting, cutting wood, driving fence posts, building houses and storing food." Donmoyer said use of the stars not only applied to outdoor agricultural activity, but also domestic and interpersonal affairs — everything from the best timing to bake bread and make vinegar to the opportune period to get married and have children. One can imagine Pennsylvania Germans transfixed by a nighttime heaven of twinkling light as opposed to modern day families mesmerized by those so-called human stars on television and movie screens. Countless times they may have looked upward seeing the geometry of stars reflected accurately in the shapes of flowers on Earth. "These ideas were so prevalent that the almanac was the second most common book in the Pennsylvania German household, second only to the Bible," Donmoyer said. By painting stars, Pennsylvania Germans displayed beliefs that were reflected and transformed by artistry. Such folk art was found on the outsides and even insides of barns in a variety of Berks County locations. What does all this say about hex signs and witchcraft? What does it say about Pennsylvania German self-consciousness about beliefs, and even later intentional suppression of those views, especially in changing times of anti-German sentiment in the 20th-century? It could say quite a lot. Donmoyer will continue to investigate. He will endeavor to interpret. But he does believe barn stars speak for themselves, powerfully and symmetrically, in what he termed a "visual vibration and rotation of their beauty." This content has passed through fivefilters.org. | |

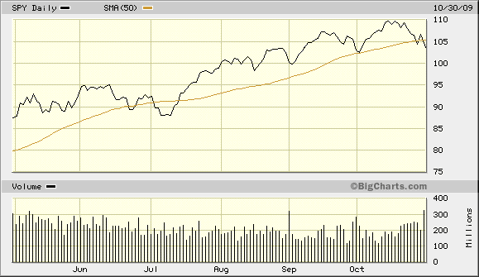

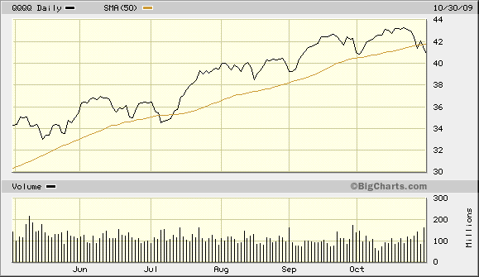

| Are ETF Trendline Changes on the Way? - Seekingalpha.com Posted: 01 Nov 2009 05:05 AM PST The week before last, the market was poised to go 8 for 8; that is, stocks hadn't lost ground since February of '09. Then came the late October spook-fest. The S&P 500 SPDR Trust (SPY) lost -4.2% last week alone, while the the PowerShares Nasdaq 100 (QQQQ) shed -5.0%. Not since July have these market barometers finished a week below their respective 50-day moving averages. Now take a look at where things stand. Might the fact that stock assets dropped below short-term trendlines be a reason to fret? Perhaps. But keep in mind, we experienced a June-July correction of 7%, only to see buyers return in force. There are some key differences, however. In the mid-June through-early-July pullback, the U.S. dollar was actually falling in value and assisting the worldwide carry trade. The pullback was primarily rooted in earnings uncertainty. Yet once bottom-line profitability for most corporations began exceeding expectations and as the dollar continued its descent, asset prices moved markedly higher. Here in late October, though, earnings uncertainty wasn't all that "uncertain." Whispers of blow-out results were commonplace. Even top-line revenue numbers were able to confirm earlier guidance. Nope, this time it was the dollar's sudden strength that sent the market spiraling lower. Consider the PowerShares Dollar Bullish Fund (UUP). For the first time since April, the U.S. dollar is actually threatening to climb above a 50-day, short-term trendline. And as if that weren't the only "threat," the CBOE Volatility Index (^VIX) is perilously close to climbing above a long-term trendline… the 200-day moving average. And that hasn't happened since March. A near-term uptrend for the U.S. dollar? A long-term uptrend for volatility? These are not desirable circumstances for the "present tense." That said, investors should keep their wits about them. The likelihood of intermediate-term strength in the U.S. dollar seems far-fetched… when both the Fed and the U.S. government are working pretty hard to keep the greenback weak. What's more, money managers everywhere are still looking for entry points to put money to work for clients who want "back in." And last but not least, according to Stock Trader's Almanac, November 1 begins the best 3-month period for historical growth in the stock market. Time will tell. (That… and the dollar!) Full Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. The company may hold positions in the ETFs, mutual funds and/or index funds mentioned above. This content has passed through fivefilters.org. | |

| Daily almanac - Columbus Dispatch Posted: 01 Nov 2009 04:15 AM PST Today is Sunday, Nov. 1, the 305th day of 2009. There are 60 days left in the year. This is All Saints' Day. HIGHLIGHTS IN HISTORY • On Nov. 1, 1765, the Stamp Act went into effect, prompting stiff resistance from American Colonists. This content has passed through fivefilters.org. | |

| On Native Ground - American Reporter Posted: 01 Nov 2009 01:37 AM PST On Native Ground | MY BACK PAGES: WATCHING MY CRAFT CHANGE OVER 30 YEARS by Randolph T. Holhut American Reporter Correspondent Dummerston, Vt.

Printable version of this story DUMMERSTON, Vt. -- I got my first job in journalism at the age of 18 in the spring of 1980. I was a freshman in college and landed a night shift gig at WSPR, a radio station in Springfield, Mass. News came over an Associated Press teletype machine at 65 words a minute. Changing the heavily inked ribbons was always a chore, not to mention making sure the paper didn't run out. Stories were typed on battered old manual typewriters that dated back to the 1940s. Computers? Still a new-fangled technology that hadn't yet seeped down to this level of the business. The Internet? There were only a few hundred people using it. If you needed to look up an address, you got a phone book or a city directory. If you needed to confirm a stray fact, you pulled out The World Almanac. They were still using reel-to-reel tape recorders, and a razor blade and Scotch tape were your tools for editing audio. It was still an analog world, with dials and meters and black telephones with dials. In the fall of 1985, when I started working in newspapers, video display terminals were cutting edge technology. Two years later, I went out and got my first computer - a Radio Shack TRS-80 Model 100 laptop. With its built-in 300 baud modem, I could file a story anyplace I could find a pay phone. Cellphones? That was as futuristic as the communicators they used on "Star Trek." There were still a few smokers in the first city room I worked in. The barroom downstairs was still a place where you could find reporters between shifts. The building also shuddered just a little from the giant presses when they fired up, and the stairwells were coated with a thin film of ink. That first newspaper company I worked for - the Worcester (Mass.) Telegram and Evening Gazette - had four morning and six afternoon editions and a dozen bureaus in the county it published in. There were two separate news staffs, and even though they worked for the same company, the competition was still fierce. One of my several jobs was working in the morgue - the newspaper's library - where we still clipped stories out of each day's edition and filed them away in envelopes. When a reporter or editor needed background on a subject, my job was to retrieve the right folders with the right clippings in a room filled with hundreds of cabinets with files that went back decades. Pneumatic tubes brought pictures up to the composing room, and page proofs came down to the copy desk the same way. The darkroom was just that, a dark room filled with a dozen photo enlargers and photographers rushing make prints on deadline. I eventually learned how to do darkroom work and how to go from taking the film out of the camera to producing a finished print in under 30 minutes. The photos from the AP came one at a time from a LaserPhoto printer, in 8 minute intervals. Waiting for photos was a constant hassle. The old photographers I encountered then were old enough to have used Speed Graphics - the bulky, hard-to-focus 4 x 5 inch cameras that were the newspaper standard from the 1920s to the 1960s. The old compositors I encountered then were old enough to remember linotypes and the smell of melting lead. The old editors I encountered then were old enough to remember pastepots and black pencils and making and remaking a newspaper on the fly with a few written instructions and a lot of teamwork in the mechanical departments. Pagination - making a pages on a computer - was just starting to creep into use. I remember the first such unit - a Mac Plus - which was used to make graphic. Within 10 years of seeing that Mac for the first time, I would be making pages on a computer. The compositors - the wizards with Exacto knifes that could do just about anything you asked, just don't touch the type, please - were out of a job. Automation changed lots of things. I was replaced by a computer terminal in the paper's morgue. Indexing was now done with a few keystrokes, not with a heavy steel straight edge tearing pages. Digital photography made the darkroom obsolete. The teletype printers disappeared, and wire service news came flying into the mainframe computers at thousands of words a minute. And now I feel as ancient as the people I met when I started out, the tribe that started out in the 1940s and 1950s, when newspapers were king and the work that reporters did was the stuff of movies. Twenty years ago this month, I went through my first buyout. The T & G had been sold two years before, and changes were in the works. Being a junior member of the staff who lashed three part-time jobs into something of a living, I was thrown overboard immediately. But I was struck by how many people, the elders of the paper that I looked up to and learned from, chose to take a buyout and leave than stick around and face an uncertain future. Most of that generation left, and I got my first education on the harshness of the newspaper business. The morning and evening papers merged the following year. The T & G's bureaus started to disappear. The presses moved out of the hulking old building on Franklin Street and went to a remote site a few miles away. The papers were sold again, this time to The New York Times Co. They eliminated zoned editions this year and the paper is struggling to survive. Since that bleak Yuletide two decades ago, I've been through three more newspaper sales. I've become an elder, talking about the old days of afternoon papers, pasting-up pages, teletypes and darkrooms to a generation that Googles phone numbers and needs MapQuest to find an address. And I've watched my profession go from fat and sassy to threadbare and dying in one generation. I'm still young enough to be a bridge between the analog and digital eras, and still looking forward to the shape of journalism to come. The tools we have now to tell stories were barely dreamed of when I started out, but I recognize how important they are and working to master them. We just have to remember that the need to tell stories is primal, and that storytellers will always be needed. What will the young reporters I work with now be saying when they look back at their careers 20 years from now? Will they be talking about that gruff and crabby gray-bearded editor they had as their first mentor? The rickety first-generation iMacs that they have to use to write their stories on? The lack of reliable Internet and cellphone service? Or will they talk about working in newspapers at a time when they became quaint relics of a bygone age? My love for the printed page is still abiding, but it's hard to remember what it was like before the Internet, before desktop computers, before digital cameras and voice recorders, before the avalanche of data that pours from the Web each day, before the 24-hour news cycle, before all the changes that I have seen in nearly three decades of broadcast, print and online journalism. The past is a nice place to visit, but the future is still the place I hope to see. Randolph T. Holhut has been a journalist in New England for nearly 30 years. He edited "The George Seldes Reader" (Barricade Books). He can be reached at randyholhut@yahoo.com.

Copyright 2009 Joe Shea The American Reporter. All Rights Reserved.

This content has passed through fivefilters.org. |

| You are subscribed to email updates from Almanacs - Bing News To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 comments:

Post a Comment